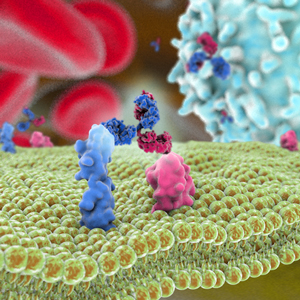

Bispecific antibodies are a versatile class of targeted therapeutics designed to bind two different sites, which can be located on a single antigen or on two antigens. Although bispecific antibodies were conceptualized ~60 years ago, various challenges associated with protein engineering, stability and manufacturing delayed their wide-spread development. However, as of 2020, numerous validated platforms, i.e., those that have produced bispecific clinical candidates, are readily available (1). Using these platforms, the commercial clinical pipeline has grown to over 100 bispecific antibodies, ranging from tandem single-chain variable fragments (scFv) to full-length immunoglobulins with dual variable domains. Substantial growth in the pipeline has occurred only relatively recently, though. During the early 2010s, bispecific antibodies comprised less than 10% of the total number of antibody therapeutics entering clinical study per year, but this number rose to 25% by 2018. Reflecting the general success of antibody therapeutics, the entry of all types of new, innovative antibody candidates into clinical study also grew substantially during this period, from 63 on average during the early 2010s to over 140 in 2018.

Bispecific antibodies are a versatile class of targeted therapeutics designed to bind two different sites, which can be located on a single antigen or on two antigens. Although bispecific antibodies were conceptualized ~60 years ago, various challenges associated with protein engineering, stability and manufacturing delayed their wide-spread development. However, as of 2020, numerous validated platforms, i.e., those that have produced bispecific clinical candidates, are readily available (1). Using these platforms, the commercial clinical pipeline has grown to over 100 bispecific antibodies, ranging from tandem single-chain variable fragments (scFv) to full-length immunoglobulins with dual variable domains. Substantial growth in the pipeline has occurred only relatively recently, though. During the early 2010s, bispecific antibodies comprised less than 10% of the total number of antibody therapeutics entering clinical study per year, but this number rose to 25% by 2018. Reflecting the general success of antibody therapeutics, the entry of all types of new, innovative antibody candidates into clinical study also grew substantially during this period, from 63 on average during the early 2010s to over 140 in 2018.

As is the case for the overall pipeline of antibody therapeutics, the majority of bispecific antibodies that have entered clinical study recently are being evaluated as treatments for cancer. Among these, the most common approach involves guiding T cells to cancer cells via a bispecific antibody, which binds to a tumor-associated antigen on a cancer cell and CD3 on T cells. Bispecifics that use this mechanism of action comprise ~45% of the pipeline. Of the T-cell engaging bispecifics now in the clinic, B-cell maturation antigen is the tumor-associated antigen most frequently targeted, followed by CD20, CD33, CD123 and prostate-specific membrane antigen. Of the bispecific antibodies in the clinical pipeline that do not re-direct T cells, the most frequent targets are programmed cell death 1 (PD1) and its ligand (PD-L1), human epidermal growth factor 2 (HER2) and vascular endothelial growth factor (VEGF). The most frequently paired targets are HER2/HER2 (different epitopes), PD1/CTLA4, PD-L1/4-1BB, VEGF/Ang-2 and VEGF/Delta-like ligand 4. Immune checkpoint proteins are frequent targets, including PD1 paired with LAG3, ICOS and TIM3, as well as PD-L1 paired with LAG3 and CTLA4.

The increased number of antibody therapeutics in the commercial clinical pipeline is due, at least in part, to the relatively high approval success rate of these molecules. Since 2014, at least 6 antibody therapeutics have been approved in either the US or European Union each year, and the number of approvals in 2020 is expected to exceed that of the all-time high of 13 approvals set in 2018 (2). Overall, antibody therapeutics have a 22% approval success rate, defined as the percentage of molecules that successfully transitioned from Phase 1 to approval of all that entered Phase 1 (3). For each clinical phase transition, the lowest rates are for the transition from Phase 1 to 2 (69%) and from Phase 2 to 3 (45%). So far, bispecific antibodies are very similar to the broader category of antibody therapeutics in their Phase 1 to 2 (71%) and Phase 2 to 3 (46%) transition rates. Since so few bispecific antibodies have reached Phase 3 or been approved, there is insufficient data for the calculation of meaningful transition rates for Phase 3 to regulatory review and regulatory review to approval. Despite this, the favorable early phase transition rates are good news for bispecific antibody developers.

In addition to success rates, the length of time required for clinical development and regulatory review is a key drug development metric. Typically for antibody therapeutics, 4-6 years is considered a relatively short period, ~ 8 years is about average, and a period of 10-12 years is considered lengthy. As with success rates, a meaningful average development period for bispecific antibodies is not available because only 3 have been approved (emicizumab, catumaxomab, blinatumomab), and 2 of these are likely not representative of bispecifics currently in clinical development. Of the 3 approved products, emicizumab, a humanized IgG4 targeting Factor IXa and Factor X approved for hemophilia, proceeded through clinical development to approval the fastest (~5.25 years), and it is most similar in structure to a canonical IgG antibody. In contrast, blinatumomab took the longest (~13 years), and it is the most dissimilar to a canonical IgG, which is typically includes human or humanized protein sequence. Blinatumomab is a tandem scFv composed of murine protein sequence with such a short half-life (2.1 hours) that continuous intravenous dosing is required for efficacy.

Because most bispecific antibodies in the commercial pipeline entered clinical studies in just the past few years, marketing approvals, if granted, may not occur for at least 4-5 years. However, two bispecific antibodies, tebentafusp and faricimab, qualify as ‘Antibodies to Watch’ (2) with late-stage clinical study primary completion dates in 2020. Tebentafusp, which is composed of a soluble T cell receptor fused to an anti-CD3 scFv (4), is being evaluated in a pivotal Phase 2 study with a primary completion date in July 2020. Faricimab is a bispecific CrossMAb (5) targeting VEGF-A and Ang-2 undergoing evaluation in several Phase 3 studies with primary completion dates in September 2020. Tebentafusp and faricimab are being studied as treatments for uveal melanoma and diabetic macular edema, respectively. Results from the clinical studies, which will help determine whether the molecules advance to regulatory review, may be available in the second half of 2020.

In summary, bispecific antibodies are entering clinical studies in record numbers, with most developed for cancer. Data available to date indicates that these molecules have similar early clinical phase transition rates, and the potential for similar development periods, compared with canonical IgG antibodies. Data discussed here will be updated and presented at PEGS Boston in the “Clinical Validation of Platforms” session of the “Engineering Bispecific Antibodies” track on Friday May 8, 2020.

1. Labrijn AF, Janmaat ML, Reichert JM, Parren PWHI. Bispecific antibodies: a mechanistic review of the pipeline. Nat Rev Drug Discov. 2019;18(8):585–608. doi:10.1038/s41573-019-0028-1

2. Kaplon H, Muralidharan M, Schneider Z, Reichert JM. Antibodies to watch in 2020. MAbs. 2020;12(1):1703531. doi:10.1080/19420862.2019.1703531

3. Kaplon H, Reichert JM. Antibodies to watch in 2019. MAbs. 2019;11(2):219–238. doi:10.1080/19420862.2018.1556465

4. Damato BE, Dukes J, Goodall H, Carvajal RD. Tebentafusp: T cell redirection for the treatment of metastatic uveal melanoma. Cancers (Basel). 2019;11(7):971. Published 2019 Jul 11. doi:10.3390/cancers11070971.

5. Klein C, Schaefer W, Regula JT. The use of CrossMAb technology for the generation of bi- and multispecific antibodies [published correction appears in MAbs. 2018 Nov 13;11(1):217]. MAbs. 2016;8(6):1010–1020. doi:10.1080/19420862.2016.1197457